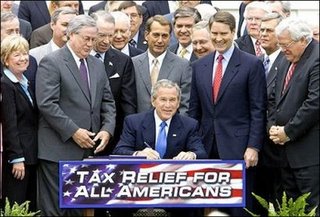

Tax Cuts Lose More Money Than They Generate, Recent Studies Conclude

"Treasury Secretary John Snow conceded Tuesday that the much-touted tax cuts for capital gains and dividend income don't drive today's strong economy.

Asked by Knight Ridder if the tax reductions paid for themselves, Snow acknowledged that they don't. He also acknowledged that economic growth and stock market gains were strong in the late 1990s, when the capital-gains tax stood at 20 percent and dividend income was taxed at rates as high as 38.6 percent."

Dennis Hastert: "If You Earn $40,000.00 a Year and Have a Family of Two, You Don't Pay Any Taxes."

1 Comments:

Somebody must have slipped a micky into Snow's drink. Republicans aren't supposed to tell the truth.

Post a Comment

<< Home